is oregon 529 college savings plan tax deductible

Oregon College Savings Plan Tax Deduction Oregon. With the Oregon College Savings Plan your account can grow with ease.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

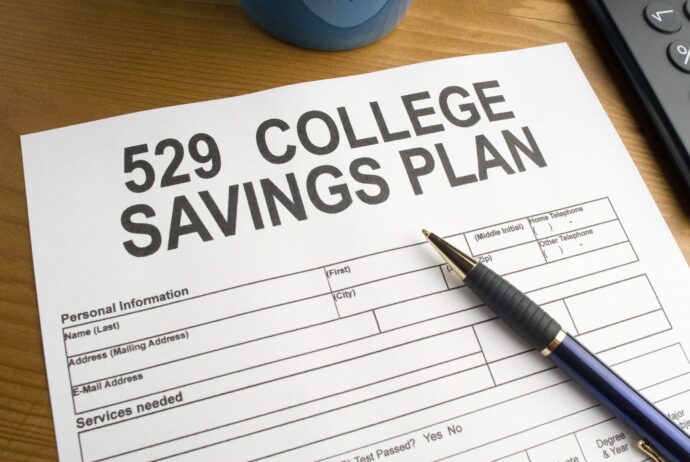

529 plan contributions are made with after-tax dollars.

. Include Schedule OR-529 with your Oregon personal income tax return. The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300 MFJ in 2020. I have not seen a location to enter my 2020 contributions to the 529 plan.

Check with your 529 plan or your state to find out if youre eligible. Compound interest adds up. Direct Deposit To deposit all or a portion of your refund into an Oregon College Savings Plan or MFS 529 Savings Plan account complete Part 1.

You may carry forward the balance over the following four years for contributions made before the end of 2019. Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan. Check with your 529 plan or your state to find out if youre eligible.

Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future. Sumday Administration LLC succeeded TIAA-CREF as program manager of the Oregon College Savings Plan on September 10 2018. The maximum amount to contribute to qualify for both the deduction and the credit is 24325 for those filing jointly or 12175 for individuals.

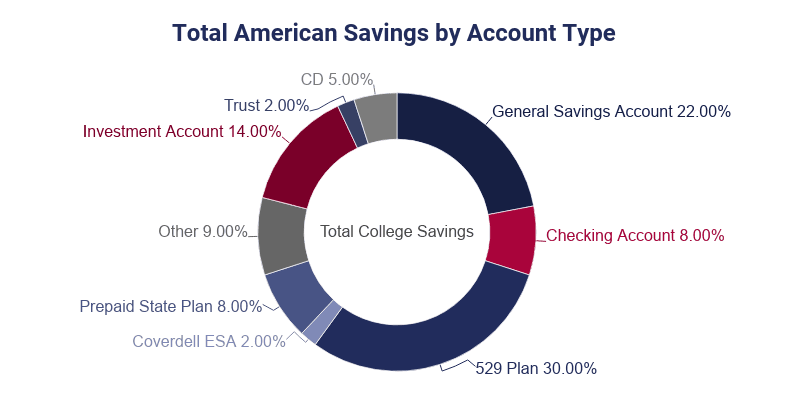

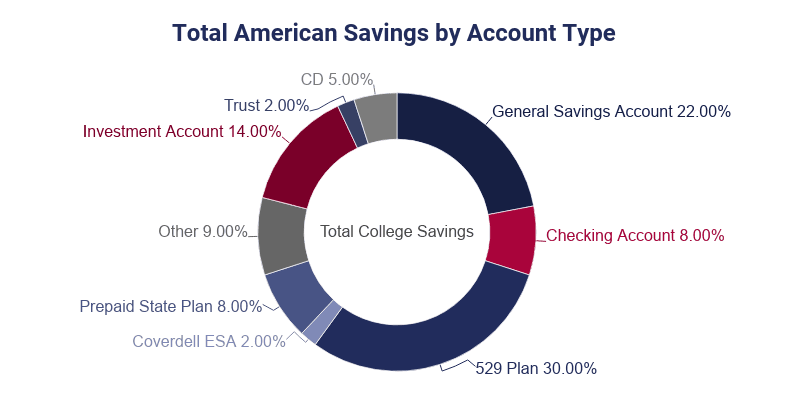

For example if a couple contributed 15000 to their sons Oregon College Savings Plan account in 2019 they may subtract a maximum of 4865 because. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive.

A non-qualified withdrawal from an Oregon 529 is subject to Oregon income tax up to recapture of prior tax deductions and tax credits received. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads.

I am using TurboTax Deluxe for Windows to prepare my Oregon state tax return and the information on deductions for the Oregon 529 College Savings Plan is contradictory in a couple of places. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. The benefit of contributing to an Oregon College Savings Plan account is that your account earnings have the opportunity to grow tax-free and so long as the money in your account is used for qualified expenses it can be withdrawn and spent tax-free as well.

When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from contributions in the 2020 year and is not a carryforward from 2019 as it specifies. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. 529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and board textbooks or other expenses related to secondary education enrollment.

And The Vanguard Group. However some states may consider 529 contributions tax deductible. If you are a resident of Oregon.

Create an Oregon College Savings Plan account. For example if a couple contributed 15000 to their sons Oregon College Savings Plan account in 2019 they may subtract a maximum of 4865 because. Sometimes for estate planning purposes or other reasons families will.

Requirements To make this choice you must have an open Oregon College. Unlike prior years these carry forward contributions must be made by December 31 2019. The tax credit provides the same maximum credit to all Oregonians who are saving for college community college trade school or any other.

Oregon College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Previously Oregon allowed tax-deductible contributions. As an Oregon taxpayer you are eligible for the 2019tax deduction as long as the contribution is.

You get a tax deduction for every dollar you contribute up to the maximum deductible amount. The plan account balance must be greater than the deduction at the end of the tax year in which the deduction. Report 529 plan contributions above 15000 on your tax return.

Its direct-sold option allows you to begin investing with a minimum deposit of 25. Earnings from 529 plans are not subject. Oregon College Savings Plan.

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan account. In 2021 529 contributions up to 15000 for individuals or 30000 for married couples filing jointly will qualify for the annual federal gift tax exclusion. There is also an Oregon income tax benefit.

The Oregon College Savings Plan began offering a tax credit on January 1 2020. For example in 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan while those filing jointly could deduct 4865. The refundable tax credit will replace the current tax deduction for plan contributions and offers Oregonians a unique opportunity to take advantage of both the tax deduction and credit.

Oregon has removed the tax deduction for 529 college savings accounts. You may carry forward the balance over the following four years for contributions made before the end of 2019. This limit will increase to 16000 in 2022.

Currently the deduction is based strictly on contributions. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. Never are 529 contributions tax deductible on the federal level.

But only on contributions made prior to December 31 2019. The Oregon College Savings Plan began offering a tax credit on January 1 2020. And Oregonians can still take advantage of this perk based on the contributions they made.

Oregon 529 College Savings Plan Options Oregon has several 529 plan options - one consumer plan and one plan that is sold by financial advisors were big advocates of doing-it-yourself you dont need. State tax deduction or credit for contributions. A 529 plan is an excellent option to start saving for your childs college education early.

Explore the benefits and see how saving for your kids future can help come tax season. Direct this 529 plan can be purchased directly through the state. That includes tax-deferred growth on contributions as well as tax.

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Tax Benefits Oregon College Savings Plan

Everything You Need To Know About 529 College Savings Plans In 2021

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Tax Benefits Oregon College Savings Plan

College Saving Statistics 2022 Average Savings 529 Balance

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

529 Savings Plan Secure The Future Best College Savings Plans Inside College Savings Plans How To Plan 529 College Savings Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

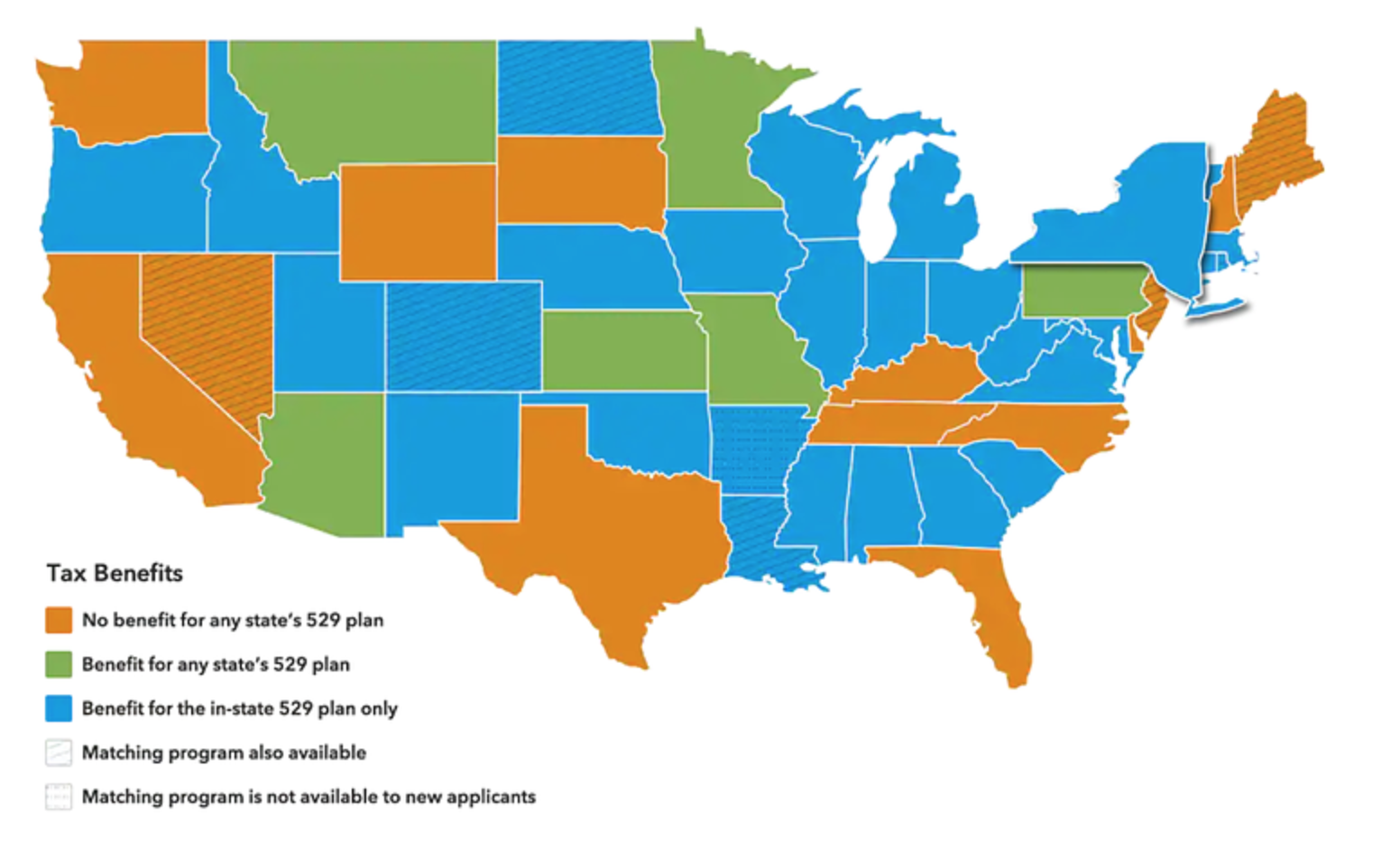

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

Straightforward Guide To 529 College Saving Plans Root Financial Partners

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

Can I Use A 529 Plan For K 12 Expenses Edchoice

10 Things Parents Should Know About College Savings

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog