us japan tax treaty social security

The US-Japan Social Security Agreement which went into effect October 1 2005 improves Social Security protection for people who work or have worked in both countries. Subject to the provisions of paragraph 2 of Article 18.

Social Security Totalization Agreements

Technical Explanation PDF - 2003.

. When it comes to the United States and the international tax treaties one of the main purposes behind the tax treaty is to help. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and. And Social Security Payments Article 24----.

You would list the foreign SS benefits on line 16a and 16b. 1 JANUARY 1973. The Security Treaty between the United States and Japan was a treaty signed on 8 September 1951 in San Francisco California by representatives of the United States and Japan in.

Protocol PDF - 2003. The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence. Foreign tax relief.

Article 71 of the United States- Japan Income Tax Treaty states that profits are taxable only in the Contracting State where the enterprise is situated unless the enterprise carries on. The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence. US Taxation of Japanese Social Security Pension On a yearly basis 70 of your pension plan distributions are taxable 7000 taxable amount divided by 10000 gross.

Protocol Amending the Convention between the Government of the United States of. Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where. Up to 85 of US Social Security payments may be considered taxable income in both the US as well as in Japan.

Income Tax Treaty PDF - 2003. An agreement effective October 1 2005 between the United States and Japan improves Social Security protection for people who work or have worked in both countries. UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28.

The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. Japanese Pension Income Under USJapan Taxation Treaty. 3 Pensions and other income Most pension distributions.

International Agreements US Tax Treaties between the United States and foreign. The United States and Japan entered into a bilateral international income tax treaty several years ago.

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

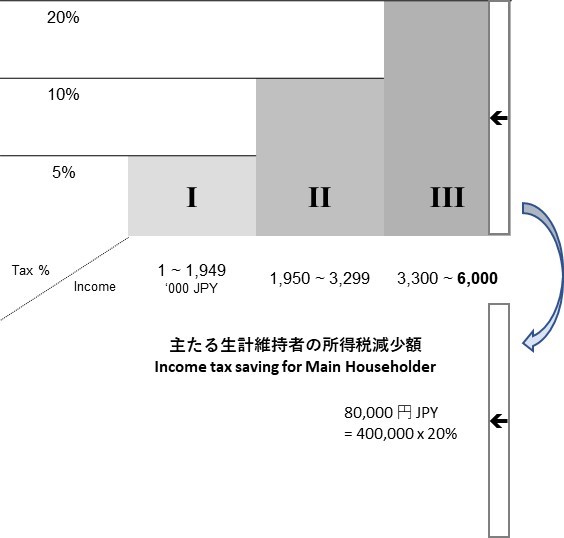

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

Social Security United States Wikipedia

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

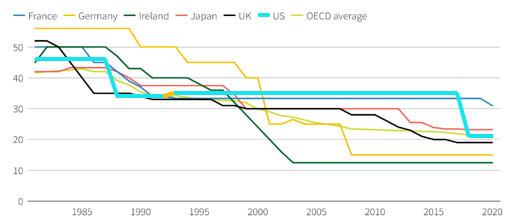

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

Publication 915 2021 Social Security And Equivalent Railroad Retirement Benefits Internal Revenue Service

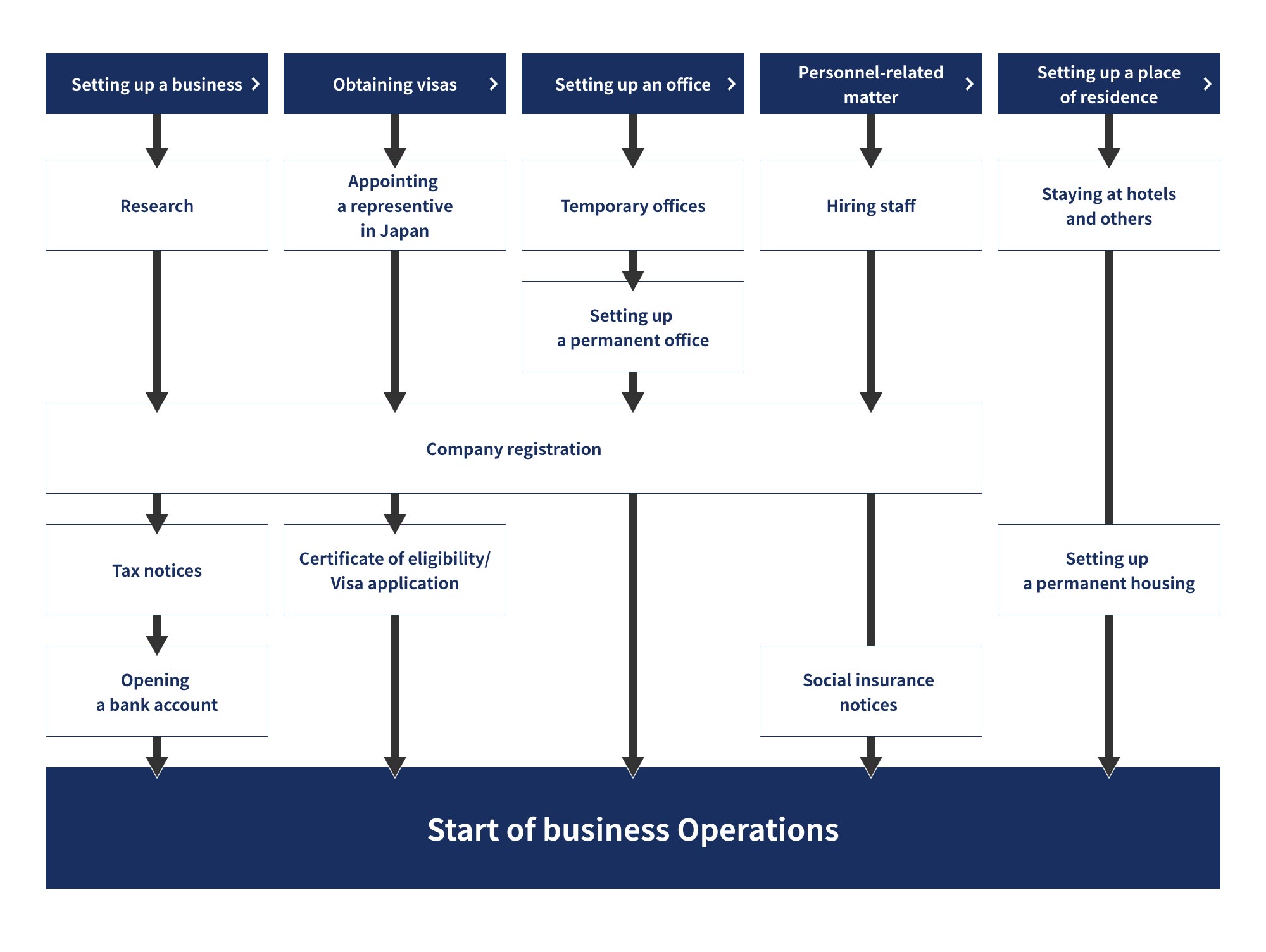

Setting Up Business Investing In Japan Japan External Trade Organization Jetro

United States Taxation Of International Executives Kpmg Global

Japan Taxation Of International Executives Kpmg Global

:max_bytes(150000):strip_icc()/hand-holding-a-social-security-check-142900507-0a20f4ec7f4c406a8249d28437f2731a.jpg)

Can You Still Receive Social Security If You Live Abroad

Us Expat Tax For Americans Living In Japan All You Need To Know

Should The United States Terminate Its Tax Treaty With Russia

Can A Foreign Spouse Receive Social Security Benefits

Self Employment Tax For U S Citizens Abroad

National Burden Taxes And Social Security Contributions In Japan Exceed 40 Of Income For Ninth Consecutive Year Nippon Com